How to trade a Symmetrical Triangle pattern? PatternsWizard

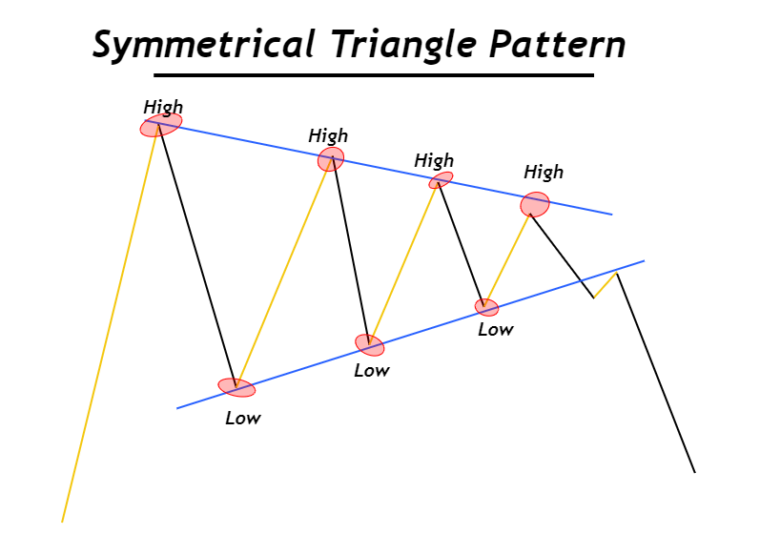

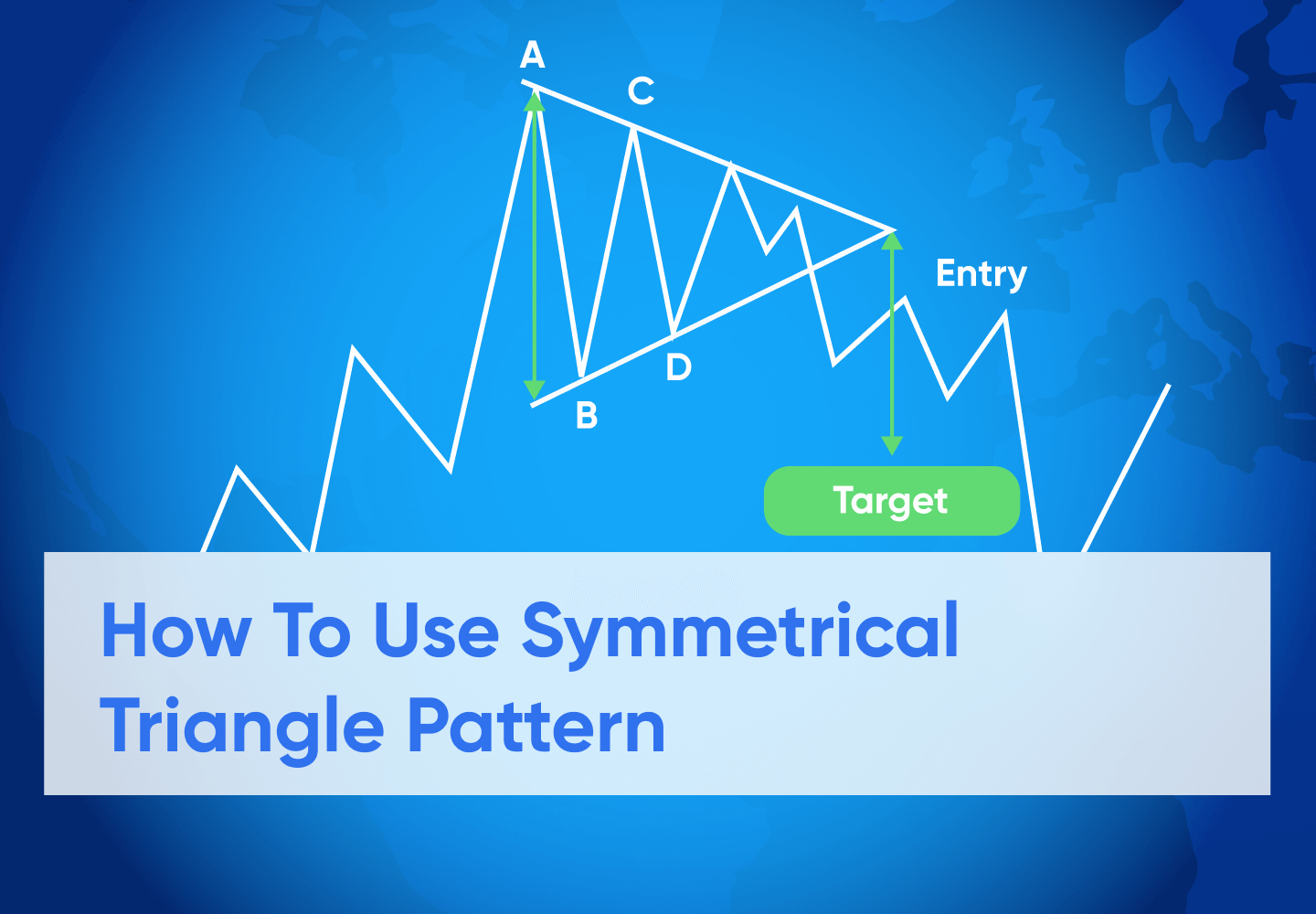

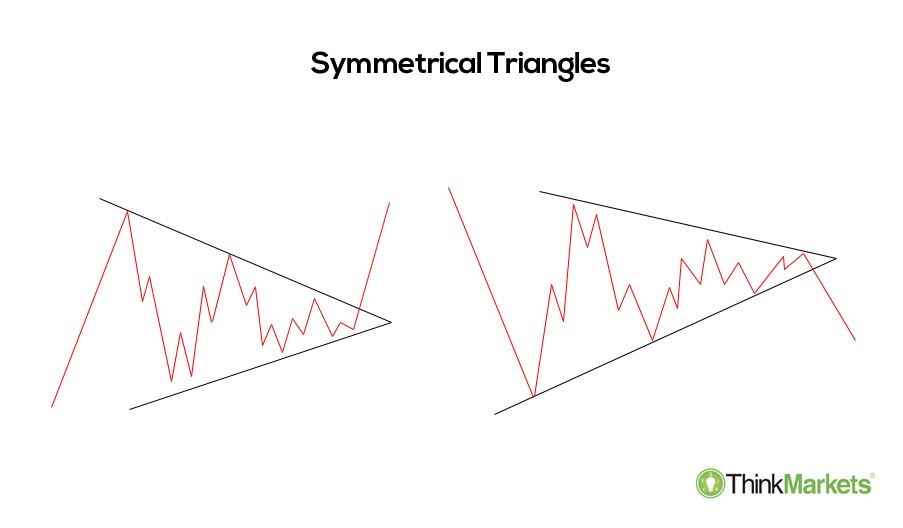

A symmetrical triangle is the most common triangle chart pattern. It is comprised of price fluctuations where each swing high or swing low is smaller than its predecessor. This coiling price movement creates a structure of a symmetrical triangle.

Symmetrical Triangle Pattern Definition & Interpretation Angel One

Symmetrical Triangle: A. 2 4 CHARTIST TRIANGLES: HOW DOES IT WORK? ANSWER is HERE! EURUSD , 1D Education 08:01 Le-Loup-de-Zurich Jan 5 ASCENDING TRIANGLE: Identify the levels where the price has often closed and opened (black line). The price is making higher and higher lows. Draw a bullish diagonal.

Symmetrical Triangle Pattern Bearish () Green & Red Bearish

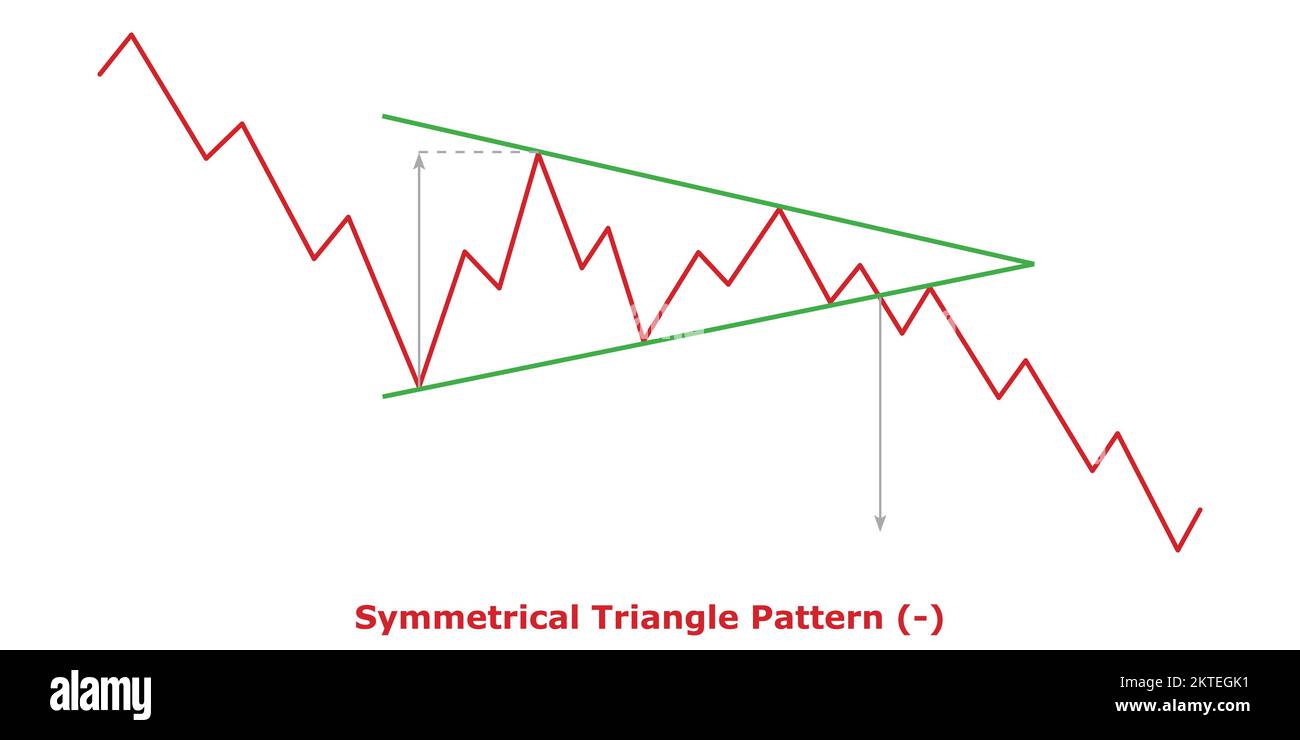

A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. These trend lines should be converging at a roughly equal slope.

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns3_2-6eb5b82169aa45859c5696835f97244f.png)

Triangles A Short Study in Continuation Patterns

A maths website kids love! Master maths with IXL's interactive programme. Unlimited maths practice with meaningful, up-to-date tracking on your child's progress.

What Is Symmetrical Triangle Pattern Formation & Trading ELM

The symmetrical triangle pattern is a continuation chart pattern like Ascending and Descending Triangle patterns. This pattern is characterized by two converging trend lines that connect a series of troughs and peaks. The trend lines should be converging to make an equal slope.

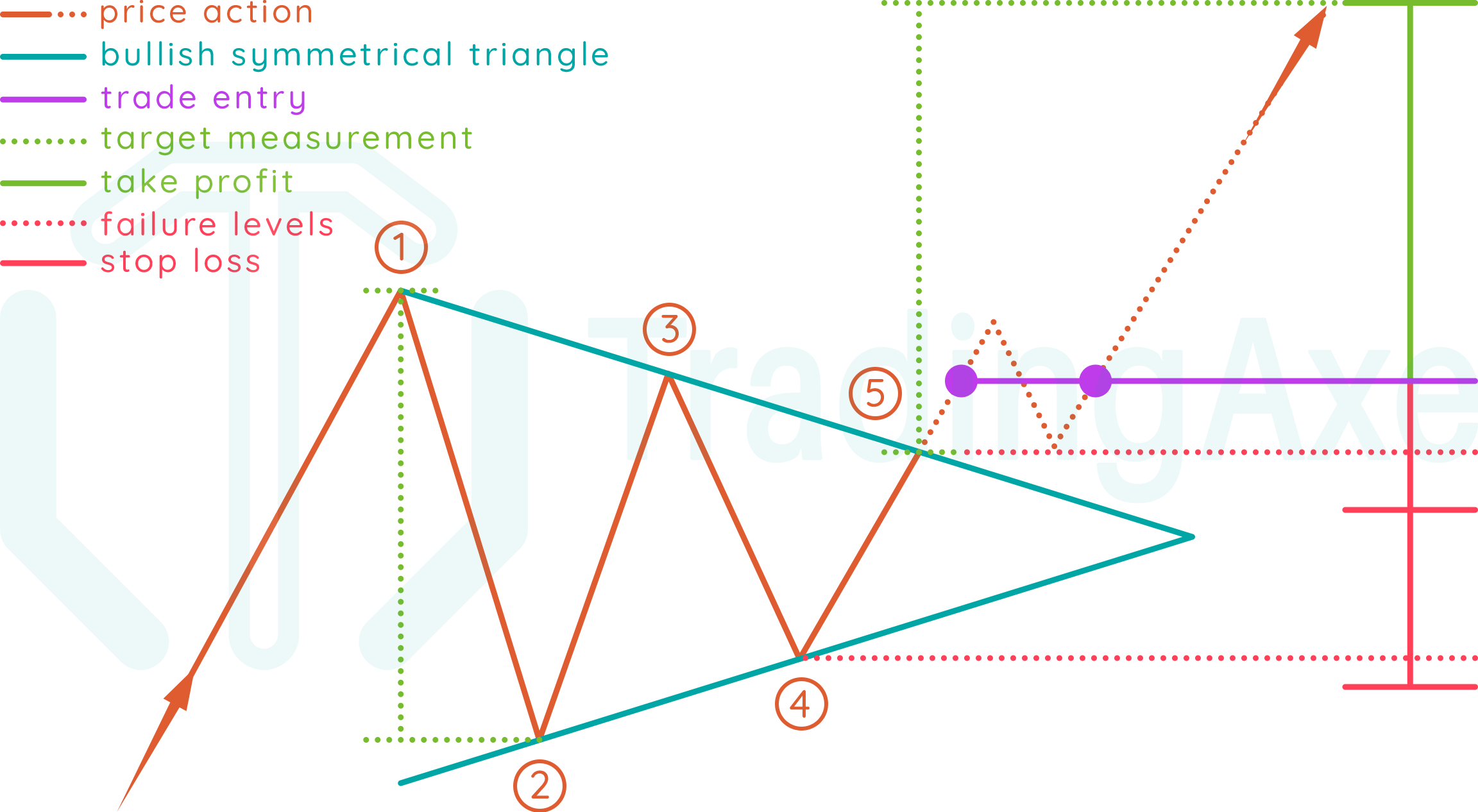

The Symmetrical Triangle Trading Strategy

Step #1: Noticing Lower Highs and Higher Lows Step #2: Check to See If the Prevailing Trend Is Moving Upwards Step #3: Waiting for a Breakout to Enter a Buying Order Step #4: Taking Profits at the Right Time Step #5: Placing a Protective Stop Loss Conclusion Symmetrical Trading Pattern Video Symmetrical Trading Pattern PDF Download

Symmetrical Triangle Pattern A Price Action Trader's Guide ForexBee

A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Pennants are continuation patterns where a period.

Symmetrical Triangle Chart Pattern Profit and Stocks

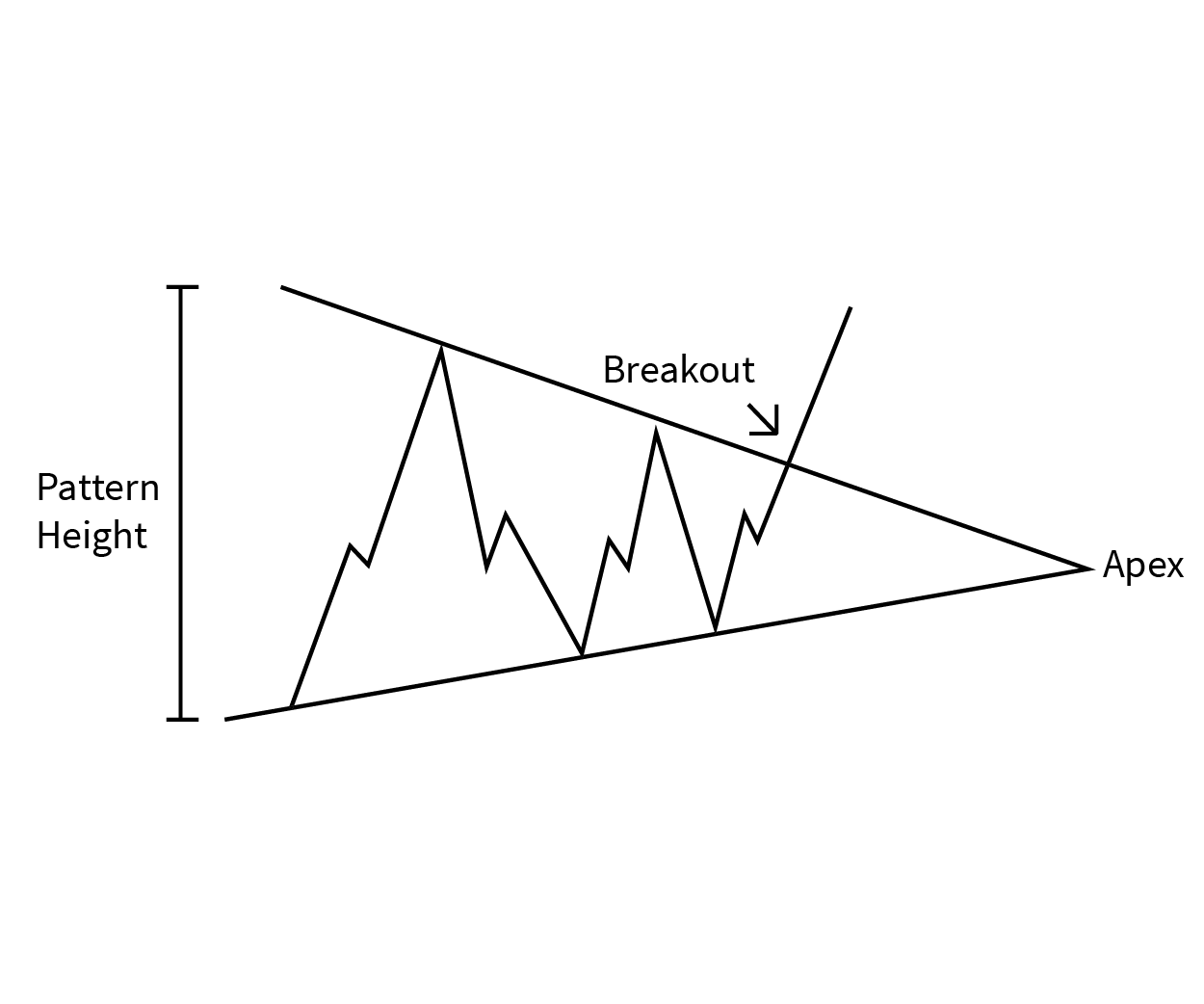

The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. The pattern contains at least two lower highs and two higher lows. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape.

Symmetrical Triangle Definition How To Trade And Use This Pattern On

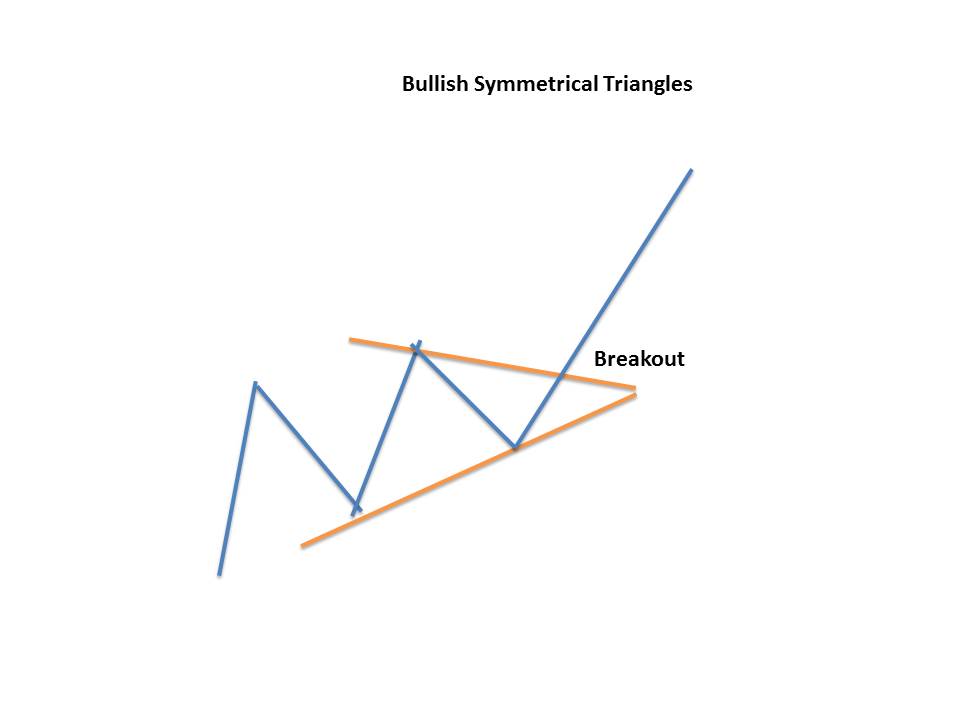

The symmetrical triangle pattern is a prevalent chart pattern observed in various financial markets, giving traders insight into the future price direction. This triangle chart pattern is formed when a security's price action converges, creating a series of lower highs and higher lows.

Triangle Pattern Characteristics And How To Trade Effectively How To

The symmetrical triangle is a technical analysis chart pattern that represents price consolidation and signals the continuation of the previous trend. It is one of the most common triangle chart patterns and is widely used by technical traders to identify entry and exit points.

Triangle Chart Patterns Complete Guide for Day Traders

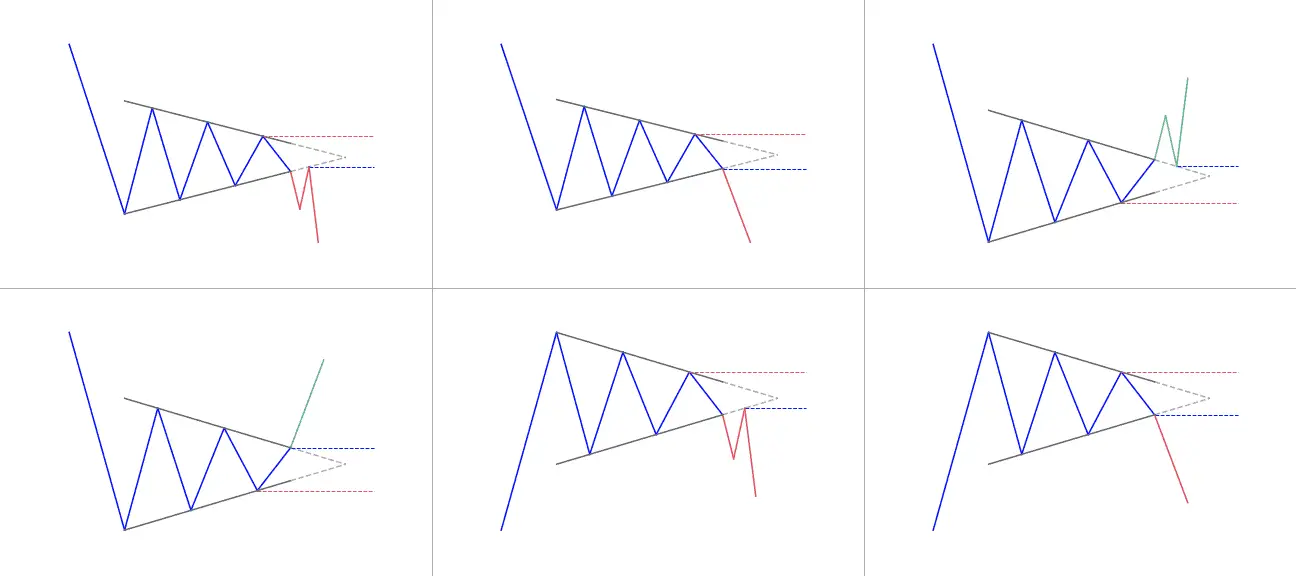

The symmetrical triangle pattern is formed by two converging trendlines. The upper trendline connects a series of lower highs, while the lower trendline connects a series of higher lows. As the pattern progresses, the range between the trendlines narrows, indicating decreasing price volatility.

Bearish Symmetrical Triangle Chart Pattern Trading charts, Stock

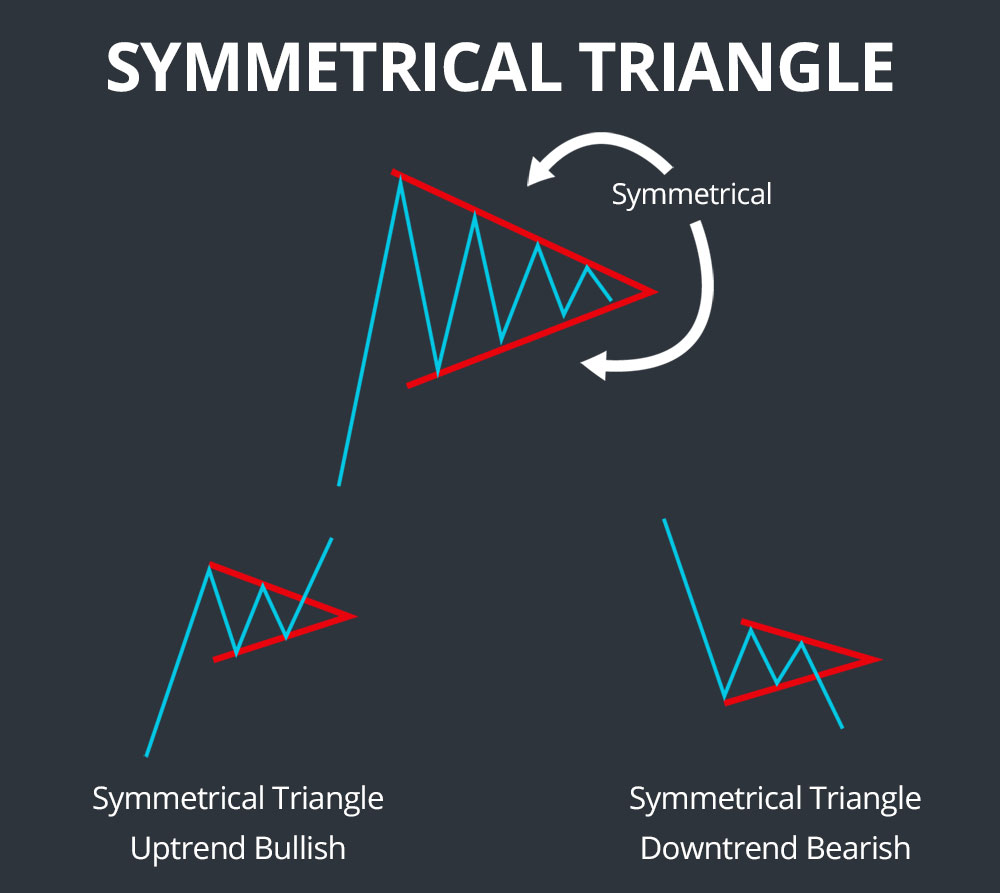

Symmetrical triangle patterns are created when there is a convergence of trends where the price is moving between two converging trend lines aligned at an equal angle. On the other hand, the formation of an asymmetric triangle happens due to an imbalance in the trend, usually characterized by a longer lower trend line while the upper trend line narrows with time.

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

A symmetrical triangle pattern consists of many candlesticks forming a big sideways triangle. It is a neutral candlestick pattern. Symmetrical triangle patterns form by connecting at least two to three lower highs and higher lows, which become trend lines. Those trend lines converge and form an apex point, forming trends as continuation patterns.

Symmetrical Triangle Investopedia

Pattern What is a symmetrical triangle pattern? A symmetrical triangle is a neutral technical chart pattern that consists of two converging trendlines. One trendline consists of a series of lower highs, acting as resistance. The other trendline consists of a series of higher lows, acting as support.

Symmetrical Triangle General Patterns ThinkMarkets

The symmetrical triangle pattern is a neutral chart formation. Two converging lines are moving to each other as the market makes the lower highs and the higher lows. As the space between two converging lines gets narrower, the likelihood of a strong breakout increases.

Symmetrical Triangle Breakouts and Example Trading Techniques in Forex

Symmetrical Triangle Chart Pattern Symmetrical Triangles: Important Bull Market Results Overall performance rank for up/down breakouts (1 is best): 36 out of 39/34 out of 36 Break even failure rate for up/down breakouts: 25%/37% Average rise/decline: 34%/12% Throwback/pullback rate: 62%/65%